Self Assessment is an essential part of the UK’s tax system, allowing individuals to report income not automatically taxed through the PAYE (Pay As You Earn) system. Whether you’re a freelancer, landlord, small business owner, or even a PAYE employee with additional income, understanding Self Assessment is key to compliance and tax optimisation. This comprehensive guide provides everything you need to know about Self Assessment, from eligibility to expert filing tips. Legacy Accounting is here to simplify your journey.

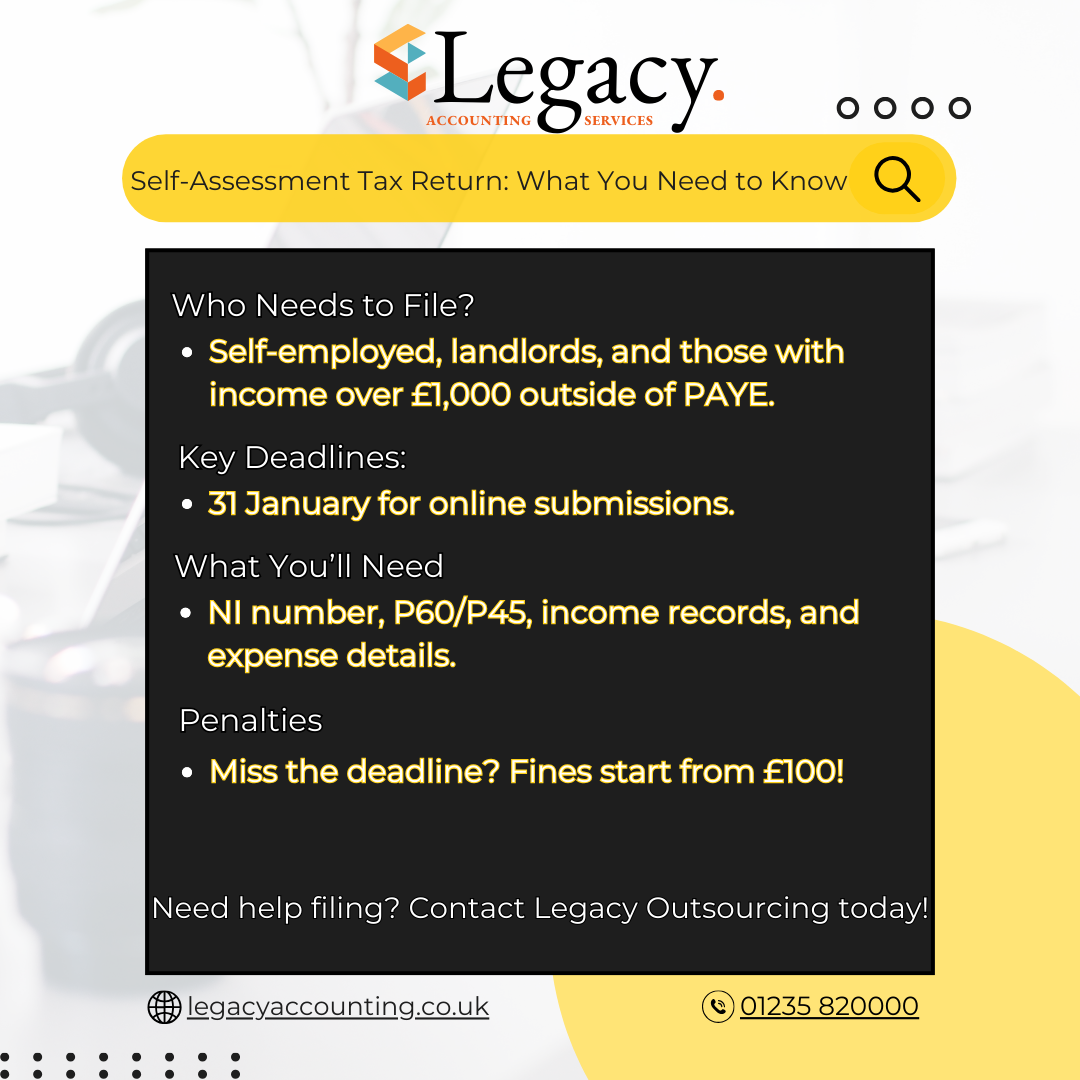

Who Needs to File a Self-Assessment?

While PAYE employees typically don’t need to file, certain taxpayers must complete a Self Assessment:

- Self-employed individuals or sole traders earning over £1,000 annually.

- PAYE employees with incomes exceeding £100,000.

- Landlords earning income from rental properties.

- Dividend recipients exceeding the annual allowance.

- High-income Child Benefit recipients earning over £60,000.

- Individuals with additional income from freelancing, consulting, or savings interest.

Practical Example: If you’re a PAYE employee with freelance earnings exceeding £1,000, you’ll need to file a Self Assessment.

How to Register for Self Assessment

If you’re filing for the first time, you must register with HMRC. Here’s how:

- Create a Government Gateway Account: This secure account manages your tax information.

- Register for Self Assessment: Complete the registration form online.

- Receive Your UTR: HMRC will post your Unique Taxpayer Reference (UTR) within 10 days. This is required for filing.

Key Deadline: Register by 5 October following the end of the tax year when you first earned untaxed income.

Key Deadlines to Remember

Staying on top of deadlines is crucial to avoid penalties:

- 5 October: Registration deadline for new filers.

- 31 January: Deadline for filing and paying online tax returns.

- 31 July: Deadline for the second payment on account, if applicable.

Late filings incur a penalty starting at £100, with additional interest on unpaid taxes. Legacy Accounting ensures timely compliance to avoid these fines.

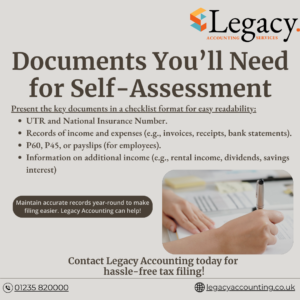

Documents You’ll Need for Self-Assessment

Efficient filing starts with organised records. Essential documents include:

- Your UTR and National Insurance Number.

- Income records (e.g., invoices, payslips, P60/P45).

- Expense receipts and bank statements.

- Additional income details, such as dividends or rental earnings.

Tip: Maintain clear and accurate records throughout the year. Legacy Accounting can streamline this process for you.

How to File Your Tax Return

Filing involves reporting all income, expenses, and applicable reliefs. Follow these steps:

- Log In: Access your Government Gateway account.

- Enter Income Details: Report all earnings, including self-employment and rental income.

- Claim Allowable Expenses: Deduct eligible business and property expenses.

- Submit and Pay: Verify all information before submission. Pay any tax due by 31 January.

Allowable Expenses: Maximise Your Savings

Claiming allowable expenses reduces your taxable income. Examples include:

- Travel: Mileage for business trips.

- Office Costs: Internet, stationery, and phone bills.

- Professional Fees: Membership subscriptions.

- Property Costs: Repairs and letting agent fees.

Tip: Keeping detailed expense records ensures you don’t miss out on tax savings.

Common Mistakes to Avoid

Avoid these pitfalls to ensure a smooth Self Assessment experience:

- Missed Deadlines: Late filings attract penalties.

- Incorrect Information: Double-check your figures.

- Unclaimed Expenses: Don’t overlook deductions.

Legacy Accounting minimises errors and maximises your savings.

High-Income Earners and Self Assessment

If you earn over £100,000, additional obligations apply:

- Your Personal Allowance decreases by £1 for every £2 of income over £100,000.

- Accurate reporting is critical for compliance and tax optimisation.

Foreign Income and Self Assessment

Income earned abroad, such as dividends or rental income, must be reported. HMRC’s double taxation agreements may prevent paying tax twice. Legacy Accounting helps navigate these complexities.

FAQs: Common Self Assessment Questions Answered

- When is the tax return due? 31 January for online filings; 31 October for paper returns.

- Can I pay my tax bill in instalments? Yes, via payments on account or HMRC’s Budget Payment Plan.

- How do I amend a tax return? Corrections can be made online within 12 months of the original deadline.

Why Choose Legacy Accounting?

Legacy Accounting simplifies Self Assessment with:

- Expert Guidance: Stay compliant with HMRC’s latest rules.

- Comprehensive Support: From registration to payment.

- Tax Efficiency: Maximise savings while minimising errors.

Ready to make Self Assessment stress-free?

Visit: https://legacyaccounting.co.uk/

Call: 01235 820000

Email: info@legacyaccounting.co.uk

Self Assessment doesn’t have to be daunting. With the right knowledge and support, you can stay compliant, avoid penalties, and even save on your tax bill. Let Legacy Accounting handle the complexities while you focus on what truly matters.

Explore More

If you’re ready to dive even deeper into tax topics, check out our detailed blog on How to Do a UK Tax Return: A Step-by-Step Guide. It’s a practical resource for understanding and managing your tax return effectively.

Let Legacy Accounting guide you through every step of your tax journey with expert advice and actionable insights.